What is Cryptocurrency?

(picture from BBC NEWS )

Bitcoin video from screenshot (BBC NEWS)

- Introduced in 2009

- Decentralised peer to peer electronic cash system

- Reward for mining

- Stored in wallets – hard/soft

Benefits

- Value = Scarcity and Utility

- Consensus of use

- Limited supply

- Decentralisation

- Transaction speed

- Low transaction costs

- Immutable

- Divisible

- Easily verifiable

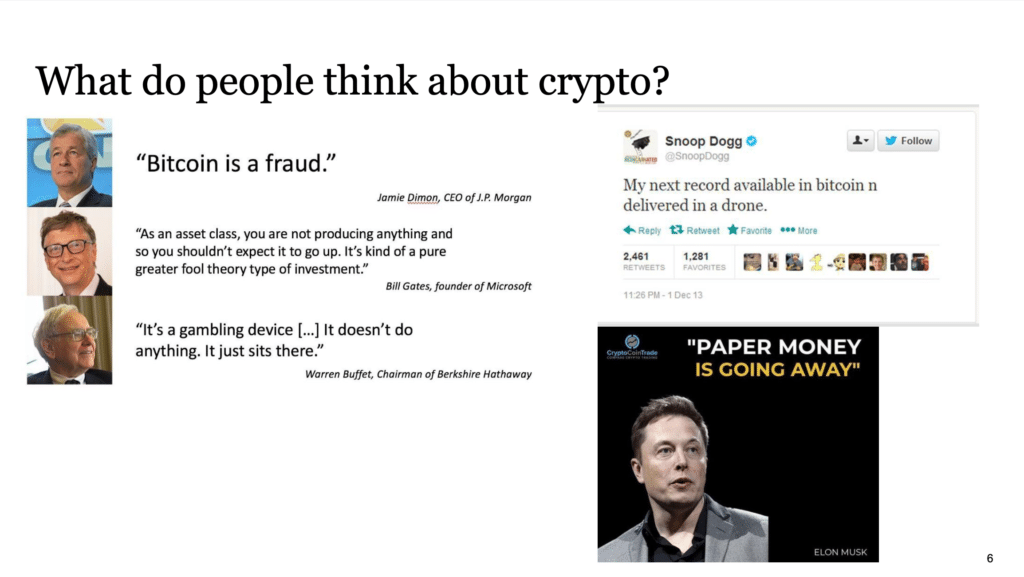

Risks and downsides

- Consensus of use

- Lack of regulation

- Volatility

- Security perceptions

- Competing Platforms

- Carbon footprint

Risks and downsides

- Consensus of use

- Lack of regulation

- Volatility

- Security perceptions

- Competing Platforms

- Carbon footprint

Cryptocurrency business and investment relevance

Companies now holding it on the balance sheet:

- Tesla

- Square

- Coinbase

Companies with blockchain projects

- Amazon

- Tesla

- ASX

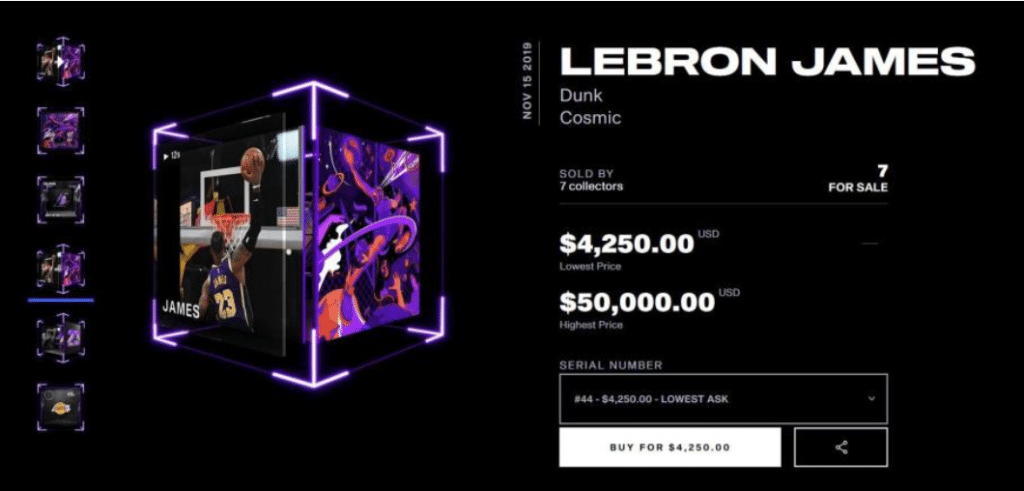

Blockchain use cases: Non-Fungible Tokens (NFTs)

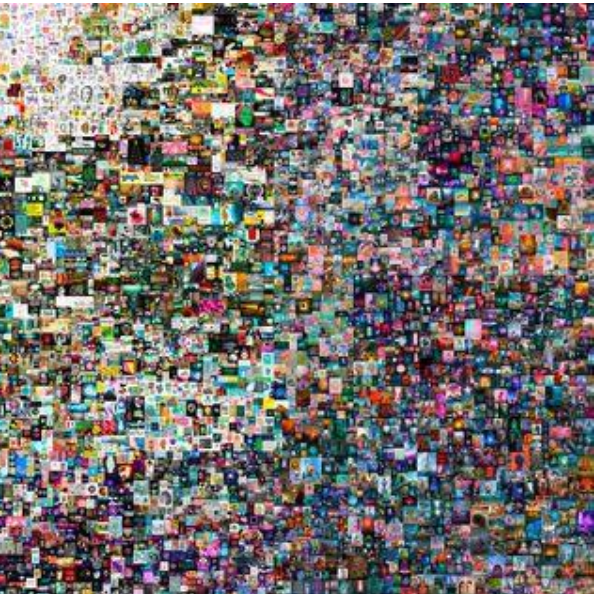

- Any digital asset can become an NFT, including music, art, collectibles and videos.

- Noteworthy example: digital artwork “Everyday”: the First 5000 Days” sold for US$69.3m in March.

- NFTs can be used to secure digital ownership and protect intellectual property rights.

Tax implications of cryptocurrency

Key ATO concepts/positions

Tax Implications of Crypto

Each cryptocurrency is a separate capital asset: TD 2014/26.

Cryptocurrency is not a ‘foreign currency for purposes of Division 775: TD 2014/25

Bitcoin can be trading stock: TD 2014/27

The provision of bitcoin by an employer to an employee in respect of their employment is a property fringe benefit: TD 2014/28

Sales and cryptocurrency purchases are not subject to GST from 1 July 2017: GSTR 2014/3W.

Tax Implications of Crypto

Revenue or Capital?

Tax Implications of Crypto Eachcryptocurrencyisaseparatecapitalasset:TD2014/26[1].

PerTD2014/26[15],adisposalofcryptocurrencymustbereportedforcapitalgainstax

purposes if the cryptocurrency is:

- Traded, sold or gifted

- Exchanged for another cryptocurrency

- Converted to a fiat currency (e.g. Australian dollars). To calculate capital gains tax:

- Convert cryptocurrency purchases and sales into AUD

- Calculate the difference between your cost base and capital proceeds

Revenue or Capital?

When can the Personal Use Asset Exemption Apply? TD 2014/26 [17] – [21]

- Personal use asset where:

- – Acquired and used within a short period

- – Directly exchanged for items personally used or consumed.

- Not a personal use asset if:

- – Used as an investment

- – Part of a profit-making scheme

- – Used in the course of carrying on a business.

- – When it needs to be exchanged for Australian dollars (or to a different cryptocurrency) to purchase items for personal use

- – If a bill payment intermediary needs to be used to purchase items.

- For example, you are purchasing a laptop with cryptocurrency.

Tax Implications of Crypto

Revenue or Capital?

What Happens when there’s a Business?

- When held for sale or exchange in the ordinary course of a business, cryptocurrency is trading stock. Therefore, profits made on disposal are regular income: TD 2014/27.

- Examples: businesses that trade, mine or exchange cryptocurrency.

- Factors are taken into account to be carrying on business include:

- – Carrying on business activity for commercial reasons

- – Preparing accounting records

- – Profit-making intention

- – Repetition and regularity to the business activities, although one-off transactions can amount to a business in some cases: TR 92/3, TR 97/11.

What if your Business Receives Cryptocurrency?

- Cryptocurrency received for goods or services provided as part of a business is assessable as ordinary income in Australian dollars.

- The value in Australian dollars is the fair market value at which they can be obtained from a reputable exchange.

GST Implications?

- Sales and cryptocurrency purchases are not subject to GST from 1 July 2017: GSTR 2014/3W.

- Same consequences of using money as a payment.

- Standard GST rules apply where cryptocurrency is received as payment.

Are there Tax Consequences for Exchanging Crypto to Crypto?

• Exchangingcryptocurrencyforanothercryptocurrencywilltriggercapitalgainstax. • CapitalproceedsisequaltothemarketvalueofcryptocurrencyreceivedinAUD.

• Transferringcryptocurrencybetweenwalletsisnon-taxable.

Example:

- Katrinaacquired100CoinAfor$15,000.

- Katrinalaterexchanged20ofCoinAfor100ofCoinB.

- Usingtheexchangeratesonthereputabledigitalcurrencyexchangeatthetimeofthe transaction, the market value of 100 Coin B was $6,000.

- WhatisKatrina’scapitalgainonherdisposalofCoinA?

Forking / Airdrops

Tax Implications of Crypto

Forking

- No tax consequences when received.

- CGT applies when sold.

Tax Implications of Crypto

- Airdrops

- Additional tokens received = ordinary income.

- CGT applies when sold.

Arrived in or left Australia?

What are the Tax Considerations for Taxpayers who Return/Leave Australia?

• AtaxpayerwholeavesAustraliaandceasestheirAustraliantaxresidencywilltrigger capital gains tax under CGT event I1.

– Capital proceeds: market value of the cryptocurrency when the taxpayer becomes a non-resident.

– Individuals can choose to disregard the capital gain or loss. Non-residents need not declare the income derived overseas.

Taxpayers are taken to have acquired the cryptocurrency they hold on the day they return to Australia.

Foreign Cryptocurrency Exchanges

What are the Tax Implications for Trading on a Foreign Crypto Exchange?

• Australianresidenttaxpayersmustdeclaregains.

• Ifcarryingonbusinessintheforeignjurisdiction, there may be taxation consequences in the foreign jurisdiction.

ATO Activity

What Information does the ATO Require?

- Receipts of purchase or transfer of cryptocurrency

- Exchange records

- Records of the agent, accountant and legal costs

- Digital wallet records and keys

- Software costs related to managing your tax affairs What are we seeing from the ATO?

- Data-matching program

- Collection of records from designated service providers.

- Crackdown approach vs educative approach in 2020.

@from public